Credit Guarantees And Loan Information To Aid SMEs In Japan

- Admin

- Apr 20, 2020

- 11 min read

Updated: Jun 22, 2020

English Information on guarantees, loans, and their conditions for companies in Japan.

We have received a lot of inquiry from our clients and from the foreign community in Japan asking what government aid and loans are available for their businesses during the Covid-19 pandemic. We have decided to create a Covid-19 section on our blog to highlight the various support that have become available and highlight all of the requirements in English below.

If you would like to request more information or would like to talk with us, please contact us at info@equiomgroup.jp Equiom Japan can assist with the necessary paperwork for these applications. For non-clients, please drop us a line and we will do our best to help, advise you and point you in the right direction.

Please stay safe everyone and together we will make it through this difficult period and help Japan and its people recover.

In this post we will cover:

1. Credit Guarantees provided by the government

2. Finance: - No interest no Collateral loans

- Special loans for COVID-19

- Crisis-support loans from Shoko Chukin Bank

- Special subsidized interest program

- Interest reductions for 'Marukei loans'

- Eased requirement for Safety-Net loans

- Special loans to counter volatility in health conditions

- Interest reductions for improvement loans for environmental health businesses

3. For Reference: Classification of an SME or Micro-business

1. Credit Guaranteed loans

The government it said it will guarantee loans for SMEs and Micro businesses at this time, making it easier to get interest free loans.

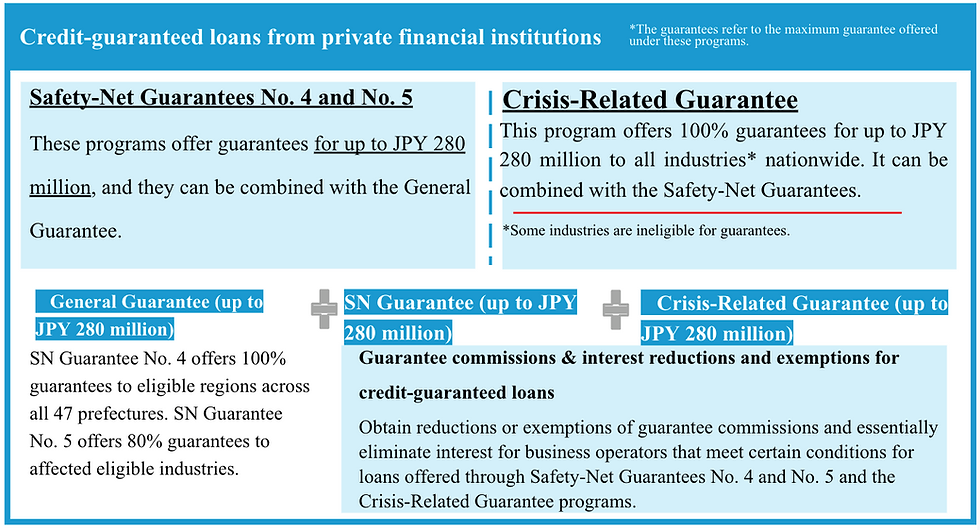

Here is a translation of the 'Safety Net Guarantee' and 'Crisis-Related Guarantee' diagram on the METI site:

Safety-Net Guarantees explained

These programs are another form of financing support that can be combined with the General Guarantee program (for up to JPY 280 million). The Safety-Net Guarantees are for SMEs that are struggling to stabilize their operations.

Safety-Net Guarantees No. 4 and No. 5

Safety-Net Guarantee No. 4

This program offers 100% guarantees of loan liabilities (for up to JPY 280 million) in regions in which a wide range of industries have been affected. It can be combined with the General Guarantee.

*Applies when an enterprise's revenue falls by at least 20% compared to the same month in the previous year

Safety-Net Guarantee No. 5

This program offers 80% guarantees of loan liabilities (for up to JPY 280 million; just as in the No. 4 framework) in industries that have suffered particularly grave impacts. It can be combined with the General Guarantee.

*Applies when an enterprise's revenue falls by at least 5% compared to the same month in the previous year

For businesses that have just been in operation between 3 and 13 months, there is an ease in the accreditation criteria: You need to compare your revenue starting on March 13th and can compare it to your average revenue for the past three months.

Which regions are eligible for No. 4? Which industries are eligible for No. 5?

Safety Net No. 4: All prefectures were designated as eligible on March 2.

Safety Net No. 5: On March 23, 587 industries were announced as eligible due to their performance in Q1 /2020.

How to use the Safety net Guarantee

1. Firstly consult with a bank or financial institution with which you maintain an account or with your nearest credit guarantee corporation, make sure they are participating, and check conditions.

2. Eligible SMEs or Micro-businesses / enterprises should seek authorization from the municipal office where their main offices (primary offices for sole proprietors) are registered, obtain the authorization application, and apply for guaranteed loans.

*On March 23, the national government had the prefectures ask municipalities to make arrangements for relaxing regulations on proxy applications by financial institutions, reducing the burden of application paperwork, and facilitating the authorization process.

Crisis- Related Guarantees explained:

In light of the financing struggles facing SMEs and micro-enterprises nationwide, business operators in all industries* across the country are eligible for the Crisis-Related Guarantees (100% guarantees), another option offering up to JPY 280 million in guarantees to SME and micro-enterprise operators that have had their sales fall by at least 15% compared to the same month in the previous year.

*Some industries are ineligible for guarantees. Contact your nearest credit guarantee corporation for more details.

By combining the Crisis-Related Guarantee (max 260m) with the Safety-Net Guarantee programs (max 260m), eligible entities could have a maximum credit-guarantee option of up to JPY 560 million.

- The process for using this program is identical to that of the Safety-Net Guarantees mentioned above.

- Using these programs may require a separate audit by financial institutions or credit guarantee corporations.

- For details on the guarantee programs, inquire at your nearest credit guarantee corporation.

Financing

Loans from government-backed financial institutions

Loan-based support has three general categories of options:

1. No interest rate reductions Safety-Net loans at reference rate Eligibility requirements: No revenue requirements

2. Interest rate reductions of 0.9%

Special loans for COVID-19 Marukei loans for the novel coronavirus Crisis-support loans Eligibility requirements: Decline in revenue of at least 5% *Flexible requirements are considered for sole proprietors (limited to micro-businesses, including freelancers.

3. Essentially interest-free loans with special subsidized interest payments

Eligibility requirements: Sole proprietors (micro): No requirements Micro-corporations: Decline in revenue of 15% SMEs: Decline in revenue of 20%

No interest, no collateral loans

Special loans for COVID-19

These loans have lowered interest rates to a flat rate of 0.9% for up to three years after the loan begins, with no credit check or collateral. The grace period can be extended to up to five years.

[Loan eligibility] Business operators that are facing a temporary decline in operations due to the impact of COVID-19, and for whom either of the following descriptions apply: 1. Business operators that have had their latest month of revenue decline by at least 5% compared to the same month the previous year or the year before that.

2. In the event that a business operator cannot simply compare revenue to the same month in the previous year (or the year before that) because it has been in business for more than three months but less than 13 months; or due to an increase in the number of stores, to a merger, or to a change of industry; or due to being a corporation (including venture start-ups) that has increased sales directly through increases in capital investments or recruitment, businesses are eligible for loans if their latest month of revenue has declined by at least 5% compared to any of the following criteria: a. Average revenue over the last three months (including the latest month) b. Revenue for December 2019 c. Average revenue for Q4 2019

*Flexible requirements for sole proprietors (limited to micro-businesses, including viable freelancers), provided they provide regular updates on the impact of COVID-19. Intended use for financing: To fund operations or make capital investments

Collateral: No collateral Loan period: For capital investments, within 20 years; For operations, within 15 years [Grace period] Within 5 years Loan limits (for additional options): JPY 300 million for SMEs, JPY 60 million for micro-enterprises/sole proprietors Interest rates: Reference rate cut of 0.9% for the first three years, with a reference rate for the fourth year and beyond SMEs: 1.11%→0.21%; Microenterprises/sole proprietors: 1.36%→0.46% Interest reduction limit: JPY 100 million for SMEs, JPY 30 million for micro-enterprises/sole proprietors *Interest rates are the same, regardless of credit or collateral, for five-year loan periods, based on the interest rate of April 1, 2020

Crisis-support loans from Shoko Chukin Bank

Shoko Chukin Bank offers financing support through its crisis-support loans for business operators that have suffered deteriorating business conditions due to the impact of COVID-19.

These loans have lowered interest rates to a flat rate of 0.9% for up to three years after the loan begins, with no credit check or collateral. The grace period can be extended to up to five years. The program takes effect in mid-April. (It started accepting applications on March 19.)

[Loan eligibility] Business operators that are facing a temporary decline in operations due to the impact of COVID-19, and for whom either of the following descriptions apply:

Business operators that have had their latest month of revenue decline by at least 5% compared to the same month the previous year or the year before that

In the event that a business operator cannot simply compare revenue to the same month in the previous year (or the year before) because it has been in business for more than three months but less than 13 months; or due to an increase in the number of stores, to a merger, or to a change of industry; or due to being a corporation (including venture start-ups) that has increased sales directly through increases in capital investments or recruitment, businesses are eligible for loans if their latest month of revenue has declined by 5% compared to any of the following criteria:

a. Average revenue over the last three months (including the latest month)

b. Revenue for December 2019

c. Average revenue for Q4 2019

Intended use for financing: To fund operations or make capital investments [Collateral] No collateral

Loan period: For capital investments, within 20 years; For operations, within 15 years [Grace period] Within 5 years Loan limits: JPY 300 million

Interest rates: Reference rate cut of 0.9% for the first three years, with a reference rate for the fourth year and beyond 1.11%→0.21% (interest reduction limit: JPY 100 million)

*Interest rates are the same, regardless of credit or collateral, for five-year loan periods, based on the interest rate of April 1, 2020

*Business operators that meet the requirements for the crisis-support loans as of March 19, 2020, and that hope to execute a loan before the program begins may use a bridge loan with interest rates set by Shoko Chukin. (These bridge loans will be rolled over once the program loans take effect.)

Special subsidized interest program

This program offers interest subsidies to SME operators that have seen their revenue plummet and that have borrowed funds through the Japan Finance Corporation’s special loans for COVID-19 and Marukei loans for the novel coronavirus, or through Shoko Chukin’s crisis-support loans.

Existing debt rolled over from the Japan Finance Corporation is also eligible to become essentially interest-free.

*The details for Marukei loans for the novel coronavirus and for rolling over existing debt from the Japan Finance Corporation may change, since the budget for the subsidies is officially established based upon the passage of the FY 2020 supplementary budget.

*The specific application process for interest subsidies is scheduled to be published on the Small and Medium Enterprise Agency’s website once the details are confirmed.

[Eligibility]

SME operators that have borrowed funds through the Japan Finance Corporation’s special loans for COVID-19 and Marukei loans for the novel coronavirus or through Shoko Chukin’s crisis-support loans, and that meet the following conditions:

Sole proprietors (limited to micro-businesses, including viable freelancers): No requirements

Micro-business operators (corporations): Decline in revenue of 15%

SME operators (excluding those in ➀ and ➁): Decline in revenue of 20%

Interest subsidies

・ Period: First 3 years of the loan

・ Maximum subsidy: (Japan Finance Corporation) JPY 100 million for SMEs, JPY 30 million for micro-enterprises/sole proprietors

(Shoko Chukin Bank) JPY 100 million for crisis-support loans

*The maximum interest subsidy is the total for new loans and rollovers of existing debt from the Japan Finance Corporation.

Interest reductions for 'Marukei loans'

Operational improvement capital loans for micro-enterprise operators (nicknamed “Marukei loans”) are a program through which the Japan Finance Corporation offers no-collateral, no-guarantor loans to micro-enterprise operators that have received management guidance from business advisers at chambers of commerce and industry, commercial and industrial associations, and prefectural federations of commercial and industrial societies.

Special measures taken in light of the impact of COVID-19

To help finance micro-enterprise operators that have seen their revenues fall due to the impact of COVID-19, this program reduces standard loan interest rates by 0.9% for the first three years, for up to JPY 10 million across all such programs. It also extends the grace period for loans to fund operations to within three years, and for loans to fund capital investments to within four years. The program took effect on March 17.

[Eligible entities]

Micro- enterprise operators that have had their latest month of revenue decline by at least 5% compared to the same month the previous year or the year before that

Intended use for financing: To fund operations or make capital investments

Loan limits: JPY 10 million besides other options

Interest rate: Reduction of 0.9% from the 1.21% management improvement interest rate (as of April 1, 2020) for the first three years

*The interest reduction limit for micro-enterprises/sole proprietors is JPY 30 million for the total interest reduction for special loans for COVID-19, special loans for environmental health and COVID-19, and Eikei loans for the novel coronavirus.

Eased requirements for Safety-Net loans

This program offers loans to help these SMEs bolster their operational foundations.

Intended use for financing:To fund operations or make capital investments

Loan limits: JPY 720 million for SMEs, JPY 48 million for Micro-enterprises/ Sole proprietors

Loan period: For capital investments, within 15 years; For operations, within 8 years

Grace period: Within 3 years

Interest rates: Reference rates: 1.11% for SMEs; 1.91% for Micro-enterprises/Sole proprietors

*Interest rates change due to the loan period and the presence of collateral, for five-year loan periods, based on the interest rate of April 1, 2020

Special loans to counter volatility in health conditions

The Japan Finance Corporation established this special loan program for Micro-enterprises/ Sole proprietors to help environmental health business operators facing barriers to financing as a result of temporarily deteriorating business conditions due to the rise of infectious diseases.

[Eligible entities]

Operators of lodging, restaurant, or cafe businesses that are facing barriers to financing caused by temporarily deteriorating business conditions due to the rise of COVID-19, and that meet any of the following criteria:

Those that have had their latest month of revenue decline by at least 10% compared to the same month the previous year or the year before that, and that expect further decreases in revenue;

Those that expect business conditions to recover and improve in the medium to long term.

Intended use for financing:To fund operations

Loan limits: Up to JPY 10 million besides other programs (For lodging businesses, up to JPY 30 million besides other programs)

Interest rate: Reference rate: 1.91%; For members of industry associations for lifestyle and health businesses that have received authorization for stimulus programs, the reference rate is 0.9%. *Interest rates are as of April 1, 2020, and they may change due to loan periods and the presence of collateral.

Loan period: For operations, within seven years (of which up to two years for grace periods)

Interest reductions for improvement loans for environmental health businesses (Eikei loans for the novel coronavirus)

This program offers the funds needed to improve operations, with no collateral or no guarantors, for micro-enterprise operators that manage environmental health businesses that have received management guidance from environmental health business industry associations.

Special measures taken in light of the impact of COVID-19

To help finance micro-enterprise operators that have seen their revenues fall due to the impact of COVID-19, this program reduces standard loan interest rates by 0.9% for the first three years, for up to JPY 10 million across all such programs. It also extends the grace period for loans to fund operations to within three years, and for loans to fund capital investments to within four years.

[Eligible entities]

Micro-enterprise operators that have had their latest month of revenue decline by at least 5% compared to the same month the previous year or the year before that.

Intended use for financing: To fund operations or make capital investments

Loan limits: JPY 10 million besides other options

Interest rates: Reduction of 0.9% from the 1.21% management improvement interest rate (as of April 1, 2020) for the first three years

*The interest reduction limit is JPY 30 million for the total of special loans for COVID-19, Marukei loans for the novel coronavirus, and special loans for COVID-19-affected environmental health businesses.

Classification of an SME or Micro-Business

When looking at the loans that are available for SMEs or Micro Businesses, it is important to properly classify what is the definition of an SME or Micro-Business.

Here are the following guidelines as set out by METI:

SMEs

Manufacturing, construction, transportation: Capitol of ¥300m or less/300 employees or fewer

Wholesale traders: Capitol of ¥100m or less/Fewer than 100 employees

Retailers: Capital of ¥50m or less/ 50 employees or fewer

Service industries: Capitol of ¥50m or less/ 100 employees or less

Hotel or Inn: Capitol of 50m or less / less than 300 employees

IT services company: Capitol of ¥300m or less/ 300 employees or fewer

Micro-Businesses

Manufacturing, construction, transportation: 20 or fewer employees

Wholesale, retail, or service industries: 5 or fewer employees

Disclaimer

Please note that information is changing daily and we advise to check regularly with the relevant government websites. The information contained in this website is for general information purposes only. The information is provided by Equiom Japan K.K. and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk

Comments